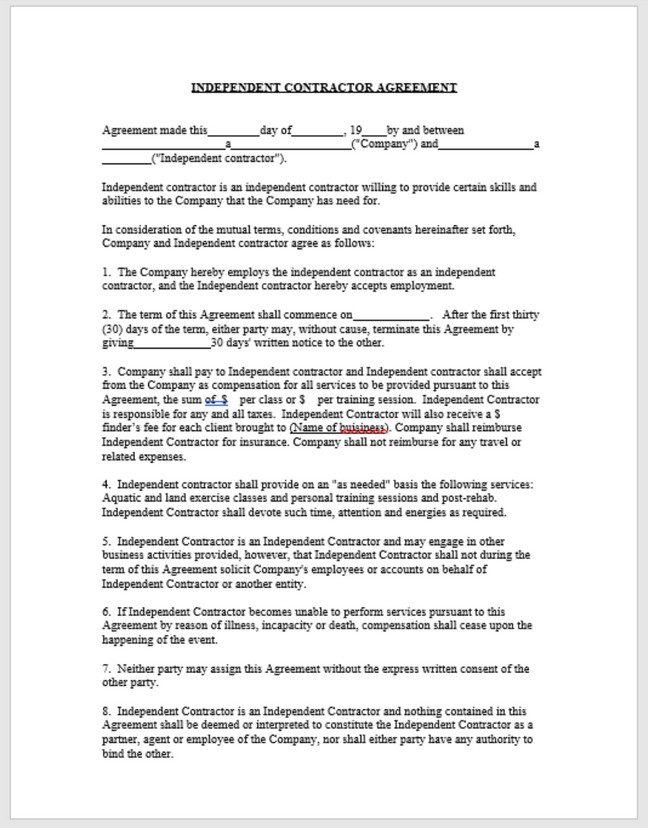

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesHere are four different contractor timesheet templates that you can download in PDF, Word, Excel, or Google Sheet formats You can choose between the daily, weekly, biweekly, and monthly templates, depending on your company's pay period 1 Daily Timesheet Template If your contract employees charge an hourly rate, you may find the dailyDo you need an employee or independent contractor?

Contract With Independent Contractor To Perform Pet Grooming Services Pet Groomer Independent Contractor Agreement Us Legal Forms

Independent contractor contract examples

Independent contractor contract examples- Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because its When you work with a 1099 independent contractor, do not withhold taxes Instead, you will provide IRS Form 1099NEC to each applicable independent contractor so that they can report their income on their tax return Give Form 1099NEC to contractors you paid $600 or more during the year

1099 Contract Employee Agreement

Let's have an insight of 25 1099 deductions for independent contractors which you may not aware of Now identify and track qualified business expenses and creates easy reporting for tax filingContractor alone is responsible for his/her payment of all applicable federal, state and local employment taxes and withholdings, and Company shall file an IRS Form 1099 reflecting all contractual payments paid by Company to Contractor under this Agreement Contractor and Company further agree that 11099 Independent Contractor – A caregiver is commonly paid as an independent contractor and not an employee;

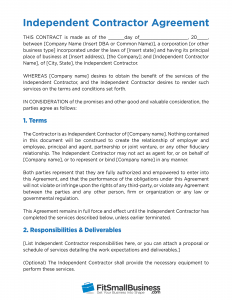

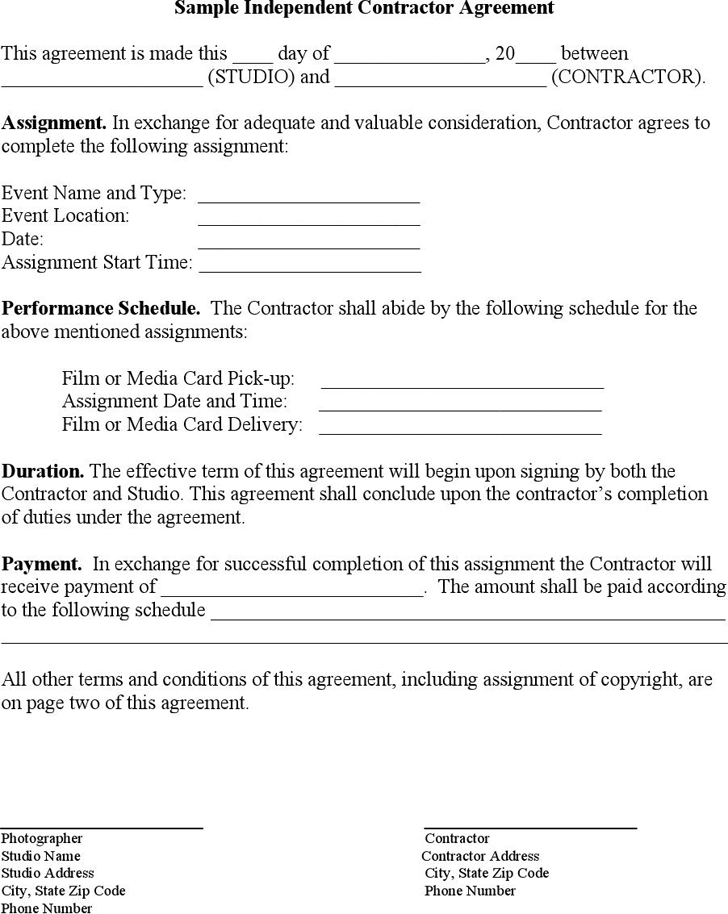

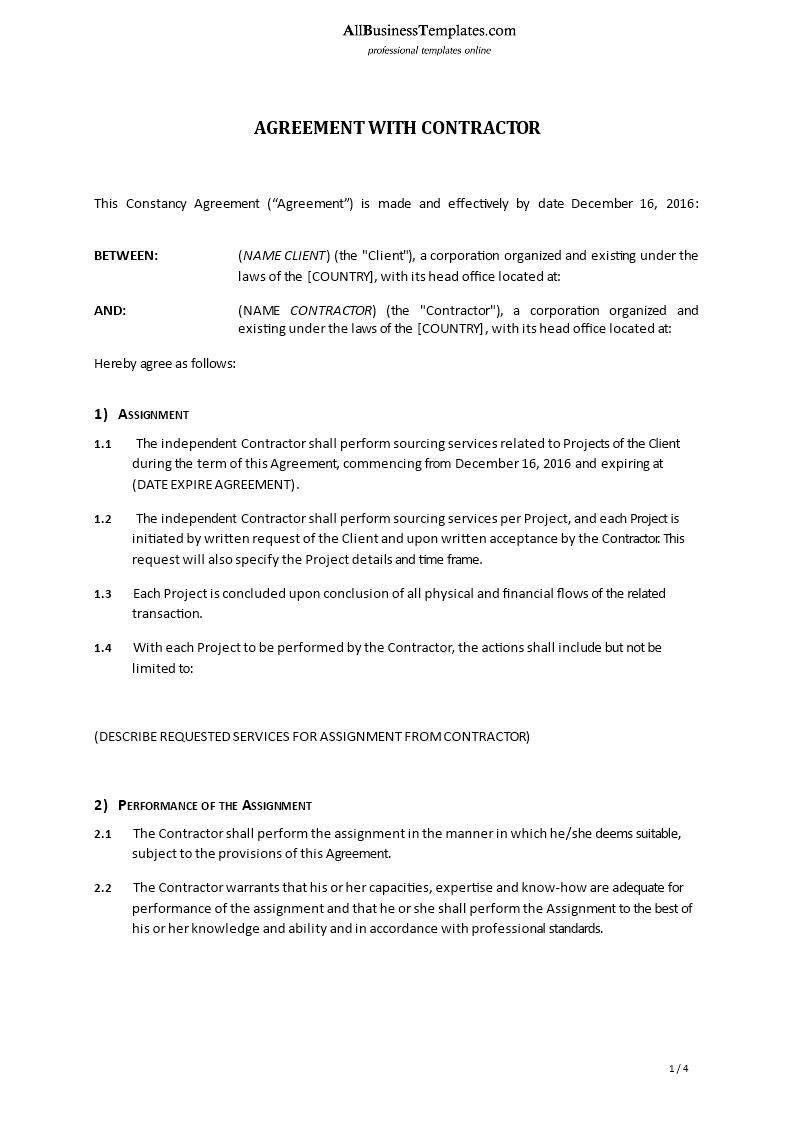

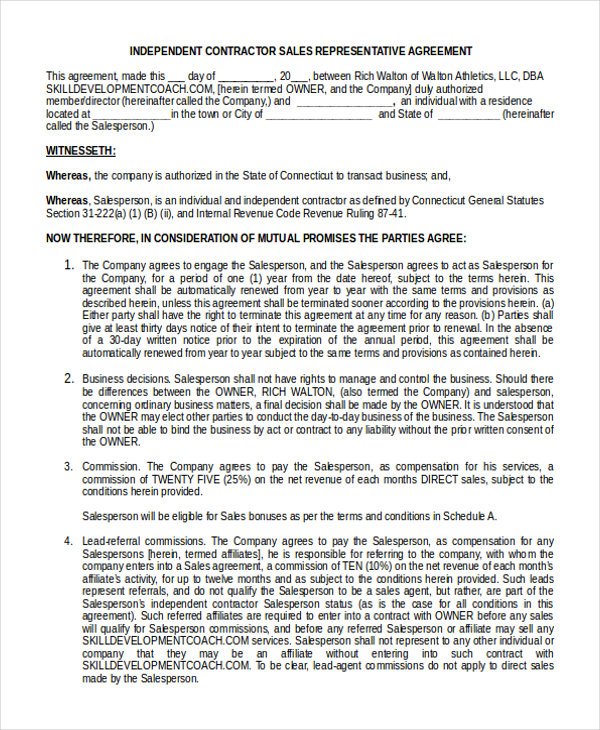

INDEPENDENT CONTRACTOR AGREEMENT It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws To the extent either Party is required by law to demonstrate compliance with any77 The contract with the independent sales rep is the best way to show that the person is an independent contractor The document should state that the sales rep is a contractor and spell out what he or she does, how often and how much he or she is paid, and provide a definition of how commission is paid out, such as getting 15 percent of each saleIndependent Contractor Agreement Templates II THE SERVICES The contractor agrees to provide the following services and/or perform the following task (s) For the purposes of this contract, these obligations will hereby be referred to as "The Services" (Here, the contractor must list out what exactly they will do for the client

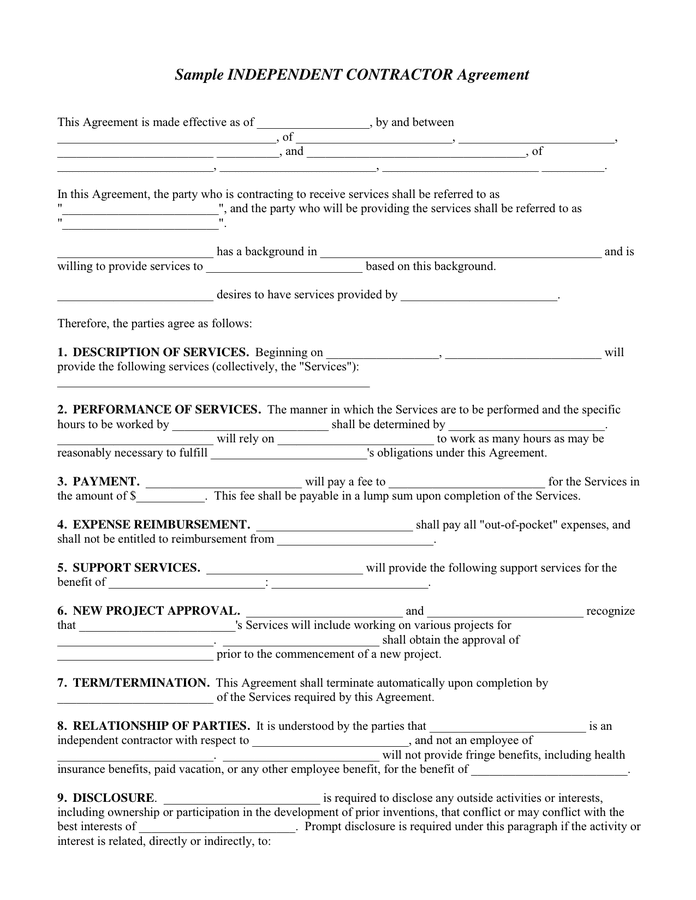

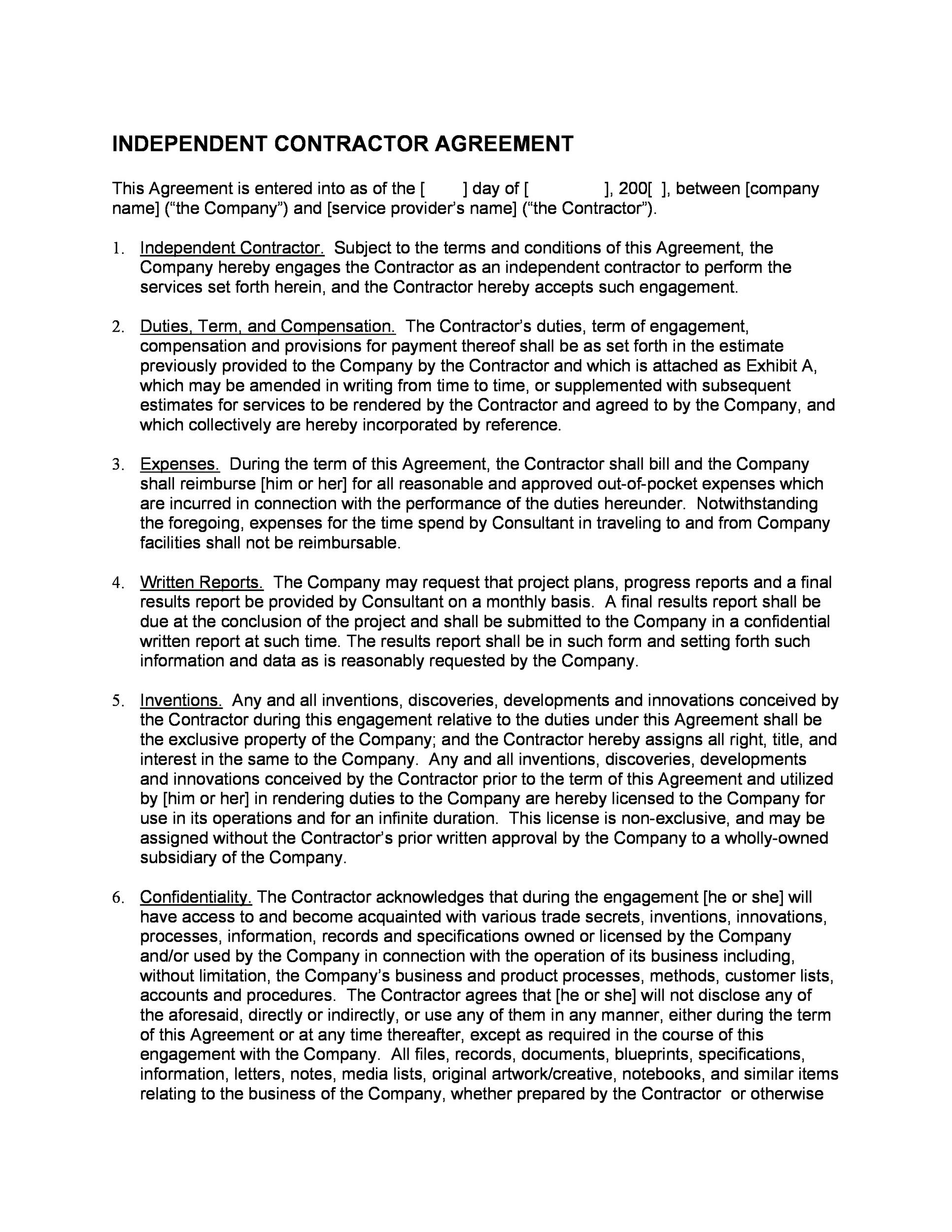

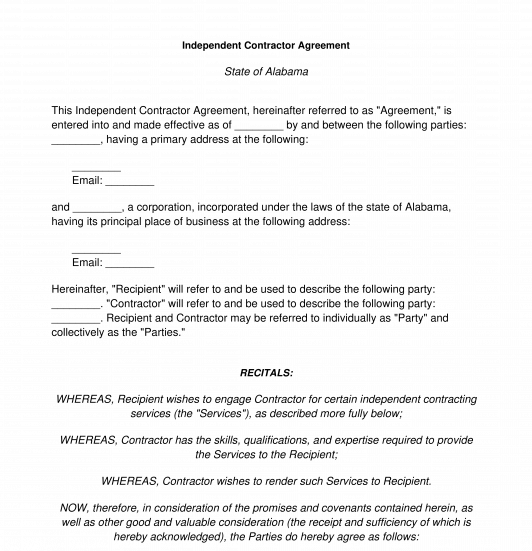

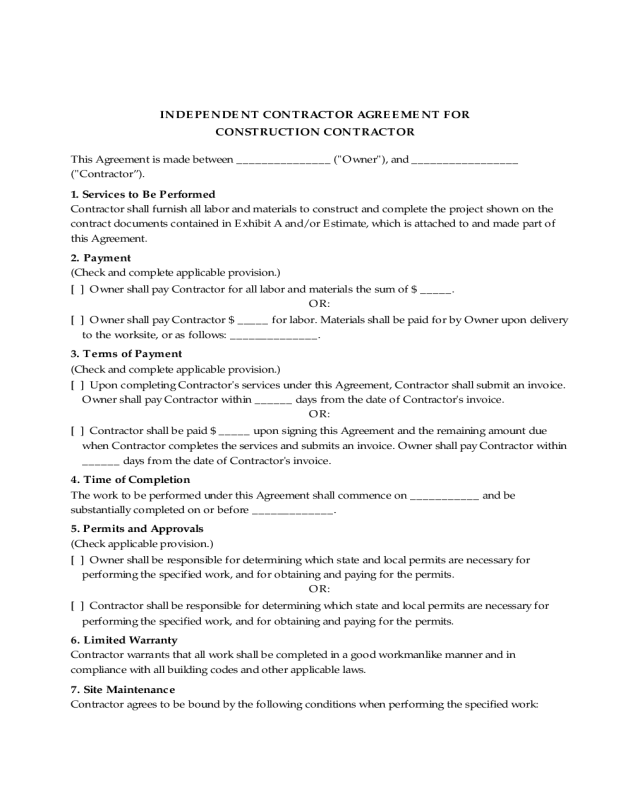

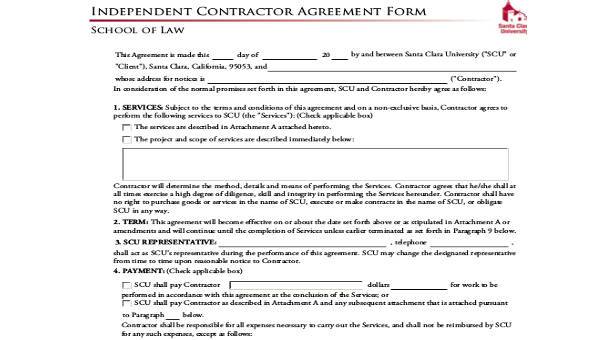

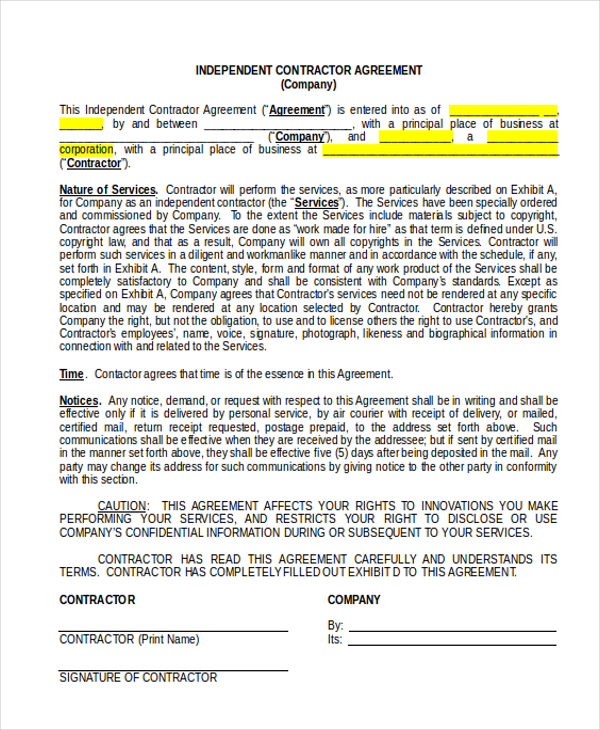

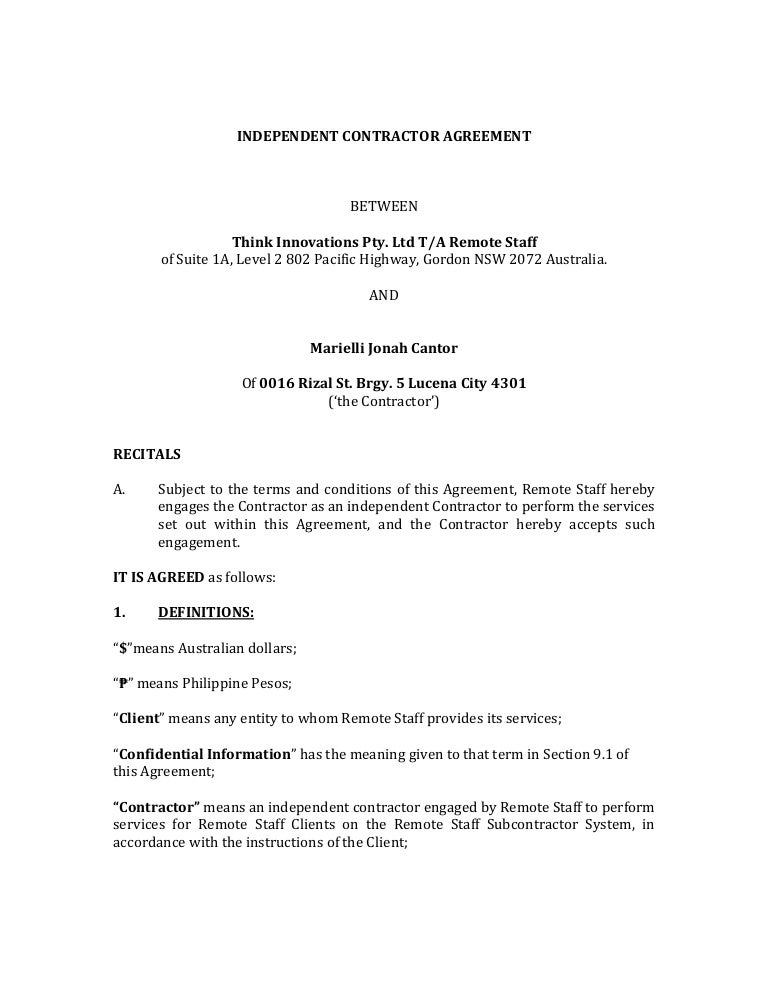

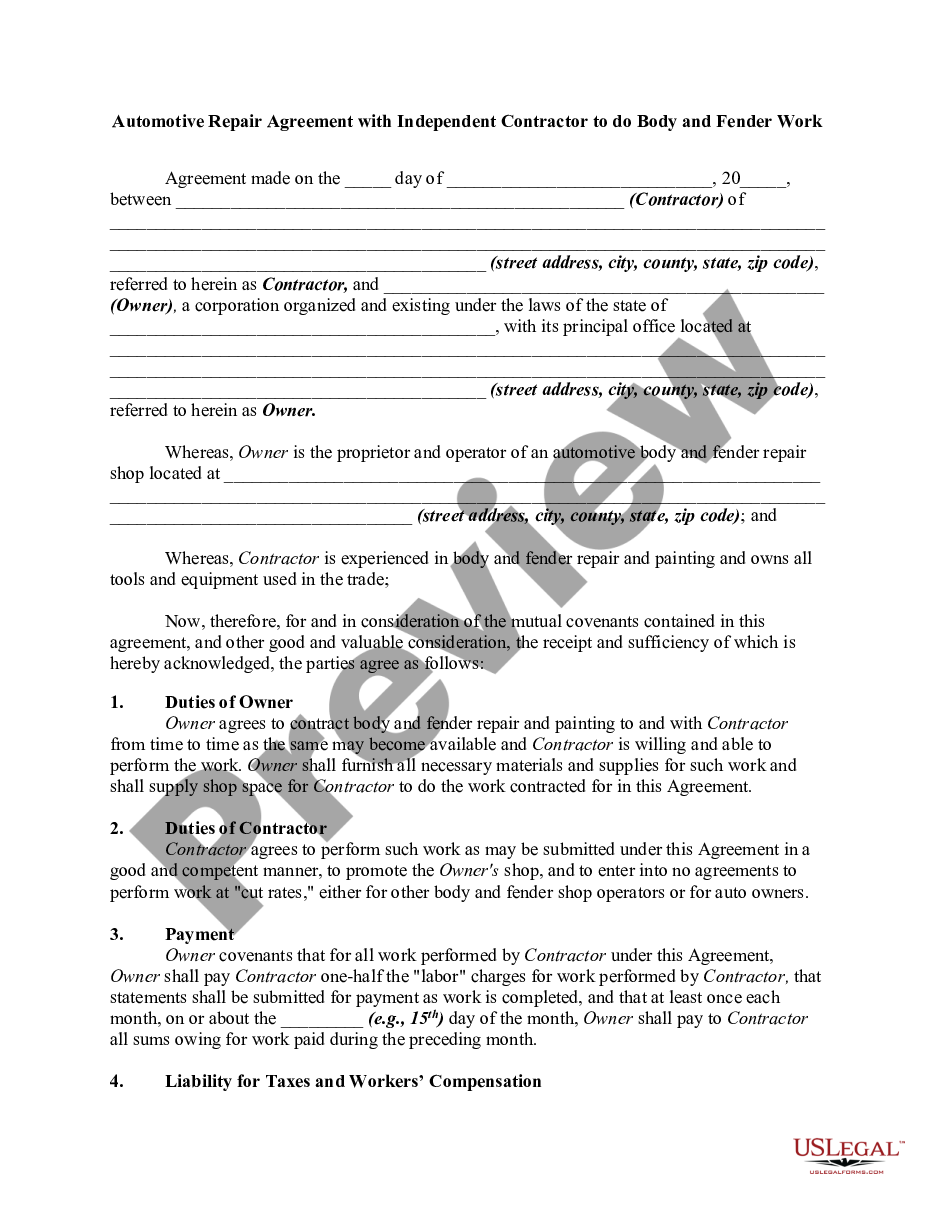

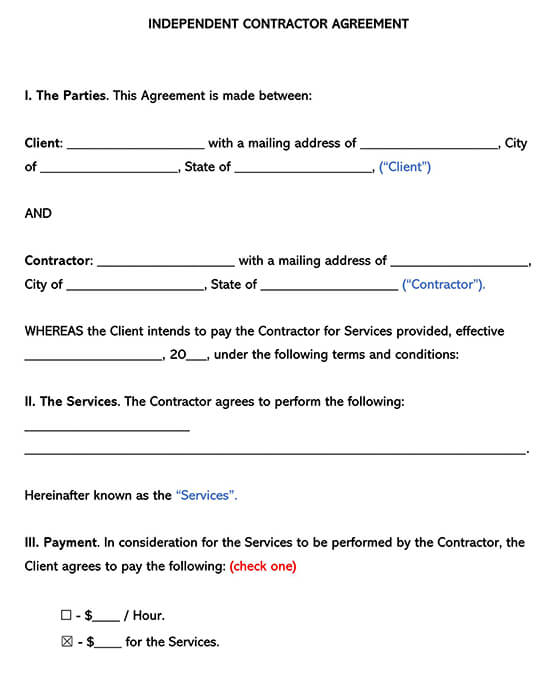

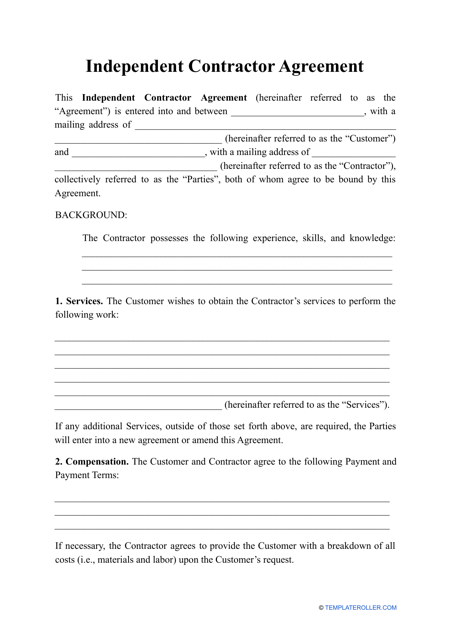

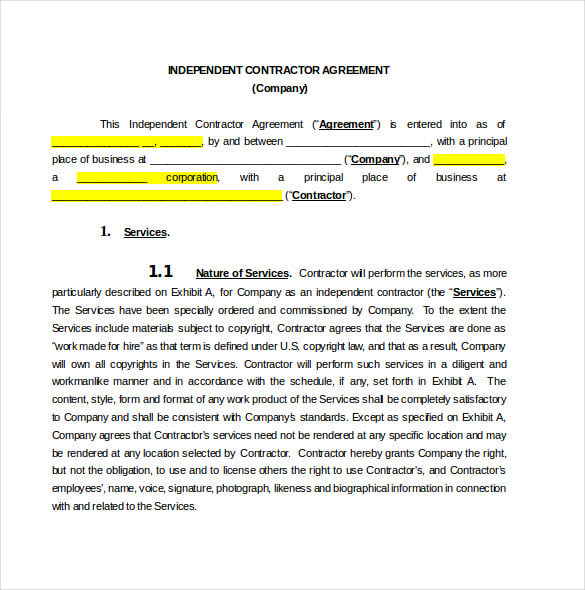

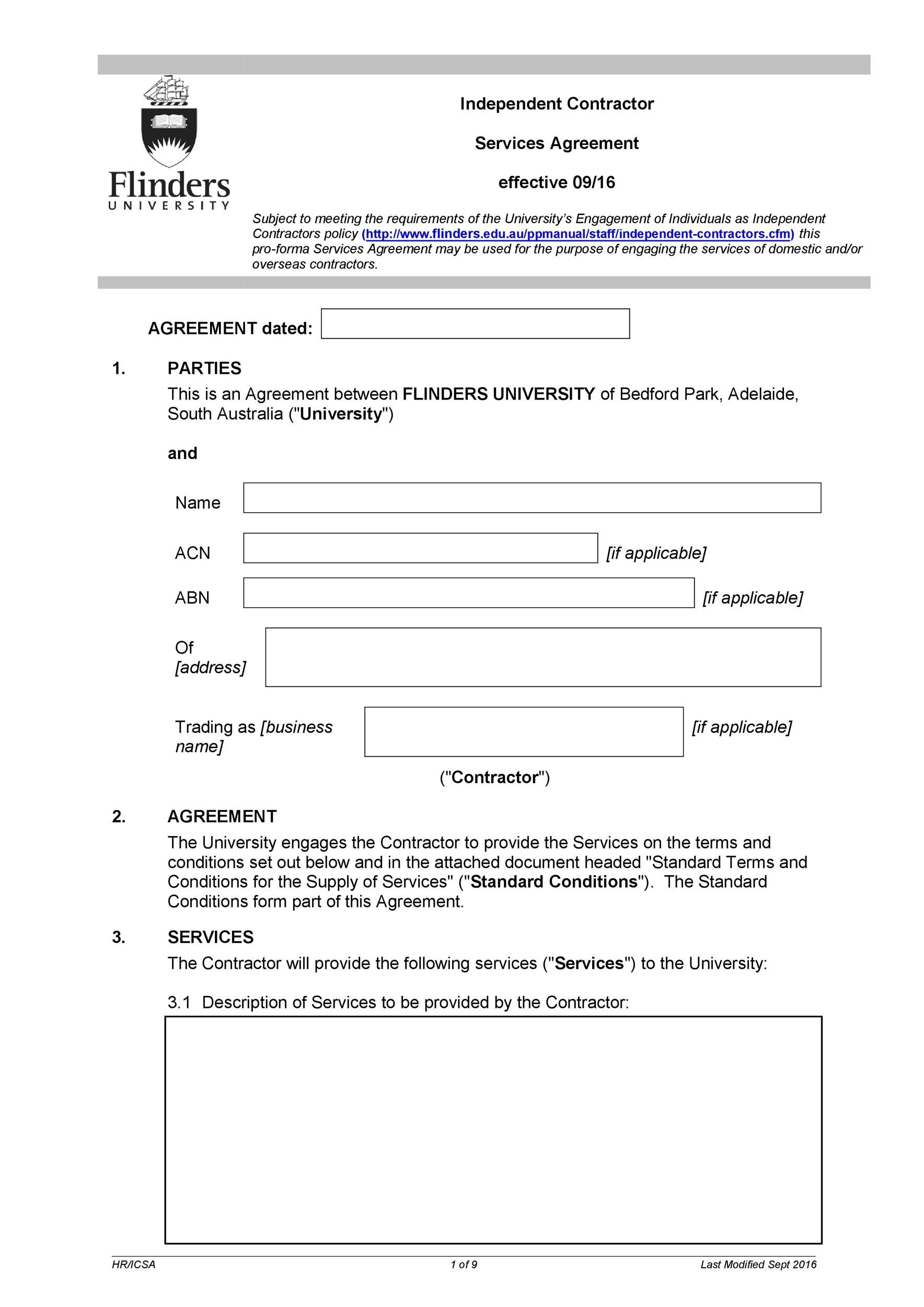

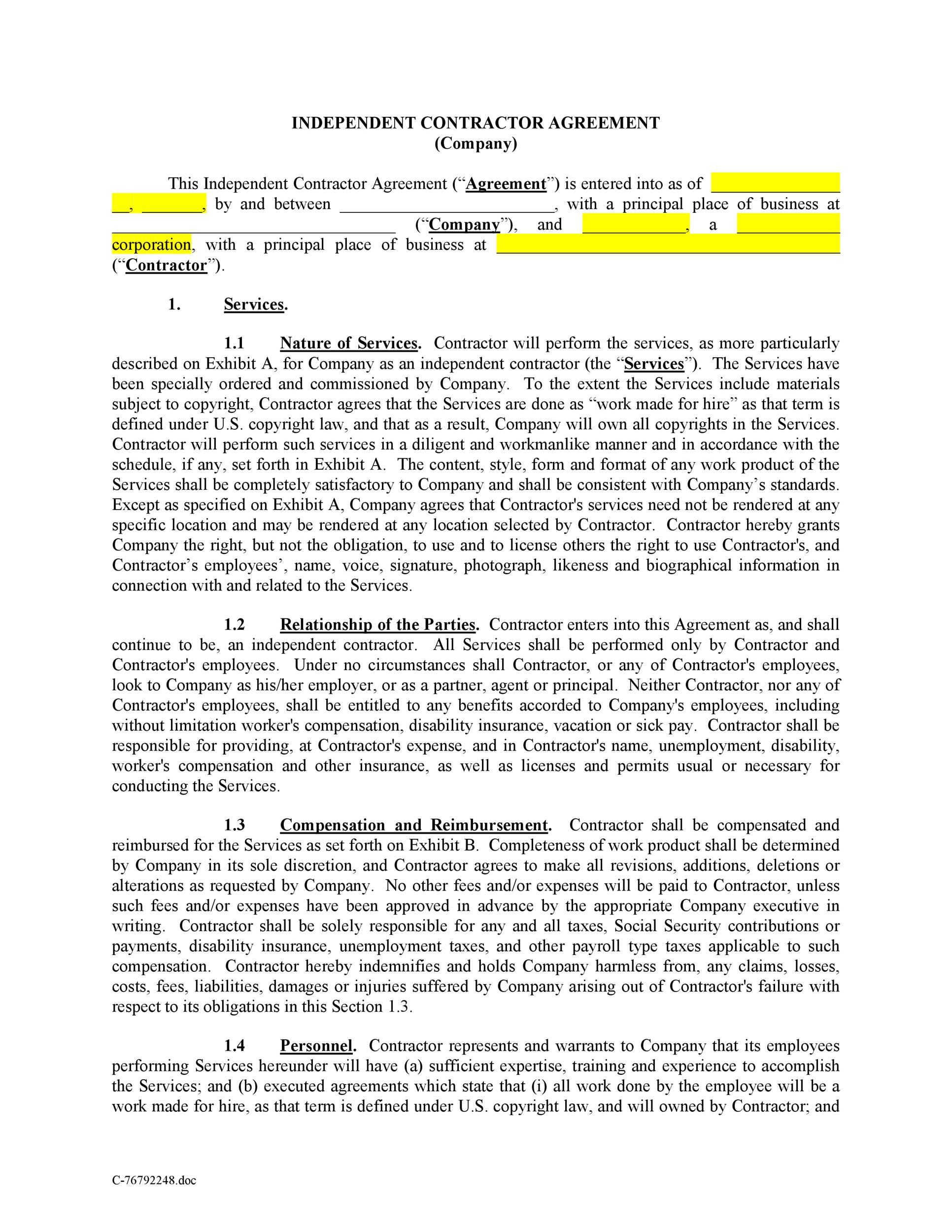

INVENTIONS (a) Independent Contractor Status1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Contractor will be compensated for the performance of Services and reimbursed for expenses as follows $____ per day Expenses paid only with prior approval of CLIENT OTHERAn independent contractor agreement is a contract between an independent contractor and the business or individual needing their services It explains the duties of both parties involved The agreement also includes a detailed description of the job that should be done, how it should be done, the payment and when it will be made, and other clauses such as a confidentiality clause

Free 8 Sample Contractor Contract Forms In Pdf Ms Word

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

Form 1099MISC 21 Miscellaneous Information Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB NoAs well as your own health benefits, medical expenses, life insurance, and retirement fundThe contract signed between a contractor and their client is known as an Independent Contractor Agreement It's often difficult to perfectly envision completed Contractor Agreement templates before creating one for yourself independent contractors must file Form 1099 when they provide their annual declaration

Free Independent Contractor Agreement Template For 21 Bonsai

50 Free Independent Contractor Agreement Forms Templates

Use this accessible employee vs independent contractor checklist template to find out This checklist template will also help you determine whether current workers are properly classified as employees or independent contractors Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these87 Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement 16 Free Pdf Google Docs Apple Pages Format Free Premium Templates

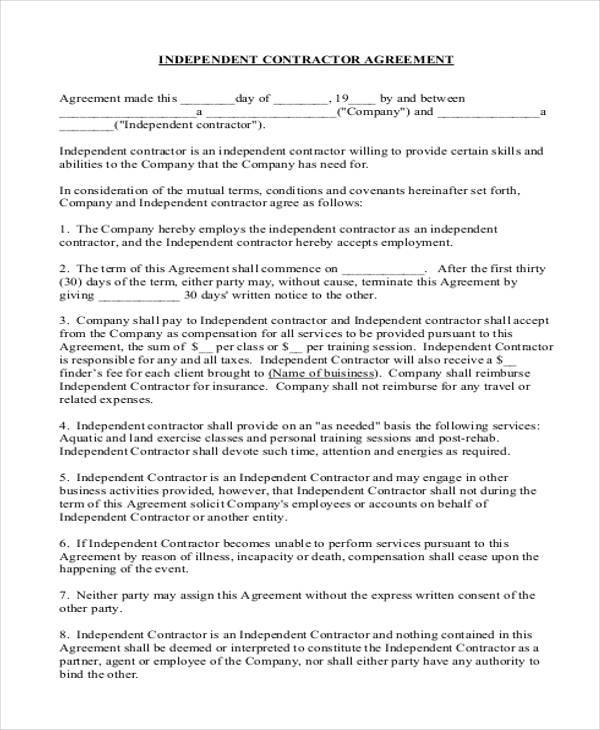

Independent contractor The Company will not be responsible for filing or paying any local, federal or state taxes Furthermore, the Company will not provide retirement or any other benefits customary to employment 2 DUTIES OF SALES AGENT Agent will carry out the customary duties of a sales representative This includes, but is not limitedIndependent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf ofYou are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Creative Services Client Contract Template Awb Firm

50 Free Independent Contractor Agreement Forms Templates

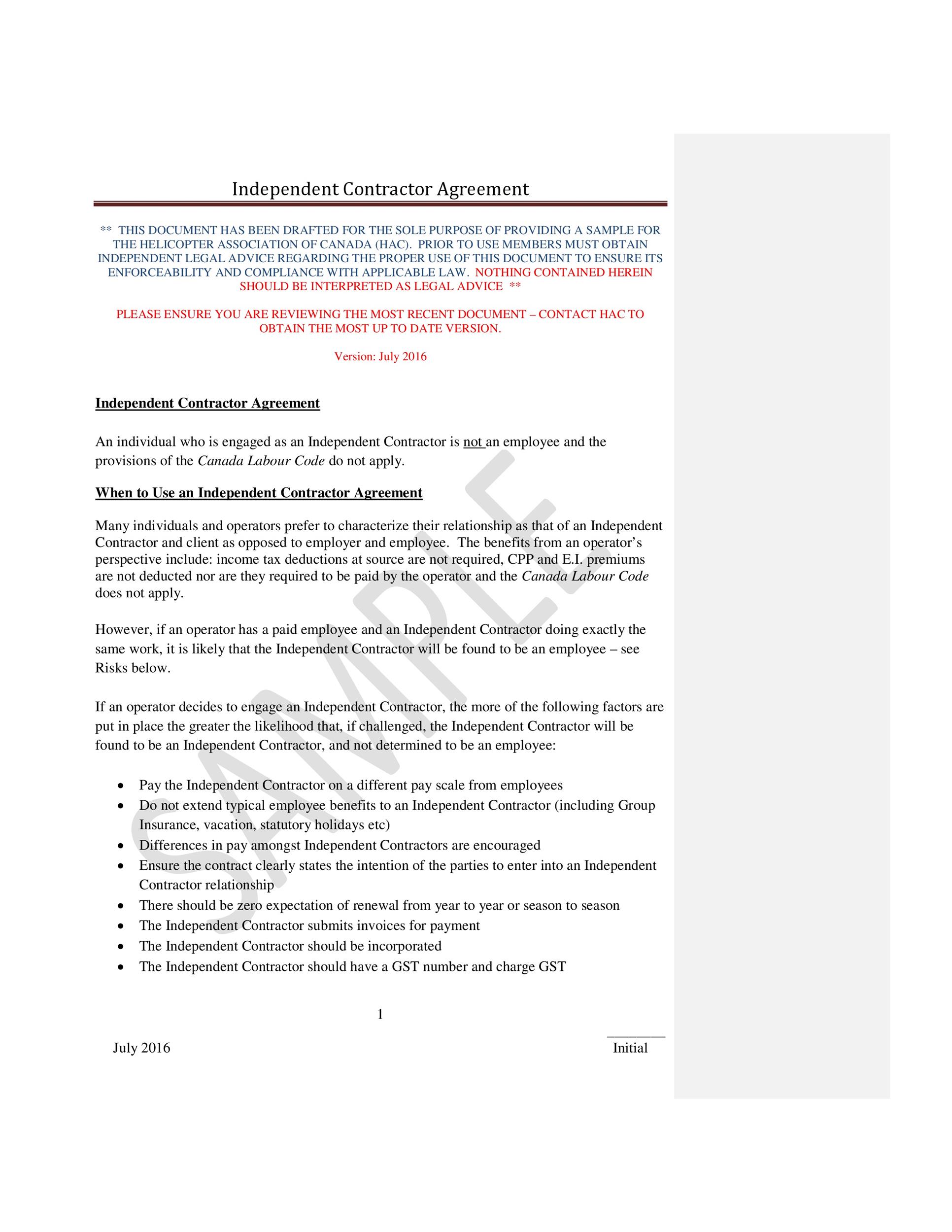

An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for payment The client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injured during the2421 The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Contract Template Fill And Sign Printable Template Online Us Legal Forms

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesThe contractor has the right to cut workrelated expenses, including inventories or other work related materials In the event that a contractor is from a foreign country, it is advisable for 12 hours of late communication, where contractors are an important factor here, if you do not want independent contractors to be free to advertise their services to others and work for how manyThe Principal and Independent Contractor hereby agree that during the term of this Agreement and any extensions hereof, this agreement and the employment of the Independent Contractor may be terminated and the Independent Contractor's compensation shall be measured to the date of such termination (i) at will by either party with 90 (ninety) day notice;

Independent Contractor Agreement Template Contract Agreement Contractor Contract Nomad Legal

73 Printable Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

5619 As an independent contractor, you're responsible for paying selfemployment tax on any income you makeSelfemployment tax can come as a shock, especially when filing your first tax return as an independent contractor The IRS defines independent contractors as those who "offer their services to the general public" and whose services are not controlled by an employer1099 Independent Contractor Pay Stub Templates 123PayStubs offers a variety of professional 1099 pay stub templates for both the employees and contractors in different styles and designs You can choose from any pay stub samples to generate a pay stub for your 1099 contractors And the best part is all the paystub templates are freeFor 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, represents that all employees and independent contractors that CONTRACTOR employs to do work for COMPANY are also bound to all of the provisions herein,

Fillable Online Independent Contractor Agreement Gc Marketing Services Fax Email Print Pdffiller

Independent Contractor Agreement Not Your Father S Lawyer

Contract employee offer letter sample Use this contract employee offer letter sample to offer candidates a fixedterm position at your company For permanent employment positions, check our formal job offer letter format and informal offer letter templates A contractor pays both the employer and the employee share of FICA taxes, which is currently 153% The contractor then deducts the employee portion of the expense (765%) on Form 1040 Making tax season with contractors a breeze Preparing and filing 1099 forms can be tedious and timeconsumingTax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here,

Free Independent Contractor Agreement Template Download Wise

Speech Pathologist Agreement Self Speech Pathologist Independent Contractor Agreement Us Legal Forms

The Contractor has no claim against the Company under this agreement or otherwise for vacation pay, sick leave, retirement benefits, social security, worker's compensation, health or disability benefits, unemployment insurance benefits, or employee benefits of any kind 4 NATURE OF RELATIONSHIP;(ii) immediately by mutualThis sample agreement template is signed between a sample contractor and a company, hence it should also include some provisions to cover any local law if applicable Both parties are governed with all terms and conditions such as term and termination of services, contractor services, Ownership and Liability, Confidential Information and other Miscellaneous Provisions

Free Florida Independent Contractor Agreement Pdf Word

Real Estate Salesman Independent Contractor Agreement Template By Business In A Box

This timesheet template enables your company to record a contractor's number of work hours applicable to the projects or programs It is an easytoedit document that can be customized as per your needs by opening it in any file format You may also read contract templates Sample Contractor Timesheet Template151 Some examples of independent contractors include truck drivers, writers, real estate brokers, and web designers It's important to know what tax deductions you qualify for so you can keep detailed records like receipts and invoices as proofThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure

Create A Free Construction Contract Agreement Legal Templates

Independent Contractor Contract Template Awb Firm

Contractor pay stub template is a handful and ready to use document produced by professional persons to help people in making contractor pay stubs at home or in office Contractor pay stub template has all essential fields and spaces that one may need to add pay related details into the contractor pay stub285 Hiring an Independent Contractor Before you hire an independent contractor, you need to have three important documents A W9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and A written contract showing the details of the agreement between you and the independent contractorOur templates These benefits are not offered to independent contractors Having a contract alone may not necessarily protect you from a contractor later claiming they were an employee, you'll have to send the completed 1099 Form to the IRS and the contract worker before January 31st of the following year

Sample Independent Contractor Agreement In Word And Pdf Formats

In Nau Edu Wp Content Uploads Sites 2 18 06 Independent Contractor Agreement Ek Pdf

So we've gathered together a few of the best free contract templates for independent contractors They'll help you outline the job requirements and payment terms, and they're available in widelyaccepted formats like Microsoft Word or Google Docs A thorough independent contractor agreement template from legaltemplatesnetRelated Agreements Babysitting Agreement – To be used for a babysitter write the house rules, compensation, and any other details for watching another's children Nanny Contract – For a nanny that is to take care of a child on a recurring basis and commonly involves6319 Independent Contractor Agreement Form Template with Sample Free Independent Contractor Agreement Form Download Business Form Template Gallery 5 1099 Employee Contract Template Oiupt 1099 Employee Agreement form Employee Contract for 1099 1099 Employee Contract Template Independent Contractor

Free Independent Contractor Agreement For Download

Free Independent Contractor Agreement Template What To Avoid

Resignation Letter Sample to Clients (Text Version) Brady Jones 123 Main Street Anytown, CA bradyjones@emailcomA service contract is between a service provider and a client It is commonly laborrelated with the service provider acting as a 1099 independent contractor Depending on the contract type, the client will either make payment at the start, during, or at the completion of the service 1099 contractors can often add just the extra burst of talent and speed you're looking for Like employees, however, independent contractors also come with a small pile of paperwork Once you've found the perfect freelancer for your project, don't let the dizzying array of forms and documents knock you off course!

1

Free Texas Independent Contractor Agreement Pdf Word

IRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the workIndependent Contractor (1099) Invoice Templates Download Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S

50 Free Independent Contractor Agreement Forms Templates

I Pinimg Com 736x 9d A3 2c 9da32c4b9eab2df66e11

Is Client Service Agreement Same As Independent Contractors Agreement In Us Quora

Www Printablelegaldoc Com Wp Content Uploads

Http Www Ct Gov Hix Lib Hix Ct Services Agreement Template Health Insurance Exchange 7 Pdf

50 Free Independent Contractor Agreement Forms Templates

1099 Contract Employee Agreement

Independent Contractor Agreement Template Easy Legal Templates

Free 10 Sample Independent Contractor Agreement Forms In Ms Word Pdf Excel

Independent Contractor Agreement Template Approveme Free Contract Templates

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contract Contractors

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreements Free Printable Legal Forms

Independent Contractor Contract Template The Contract Shop

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Sample Tennessee In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template By Business In A Box

50 Free Independent Contractor Agreement Forms Templates

3

Independent Contractor Agreement Template Contract The Legal Paige

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Sample Template

Independent Contractor Agreement Agreement For Consulting Services

Independent Contractor Agreement The Association Of Fitness Studios

1099 Form Independent Contractor Agreement

Free Texas Independent Contractor Agreement Word Pdf Eforms

Prima Independent Contractor Agreement

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Independent Contractor Agreement Business Lawyer Tampa

3

Free Independent Contractor Agreement Free To Print Save Download

2

Independent Contractor Agreement Programming Templates At Allbusinesstemplates Com

Free Construction Contract Template Sample Pdf Word Eforms

Paralegal Agreement Self Employed Independent Contractor Paralegal Independent Contractor Agreement Us Legal Forms

Contract With Independent Contractor To Perform Pet Grooming Services Pet Groomer Independent Contractor Agreement Us Legal Forms

3

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Agreement For Construction Edit Fill Sign Online Handypdf

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Independent Contractor Agreement Legalforms Org

Independent Contractor Template Contract For Va S The Legal Paige

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Agreement Template Free Pdf Sample Formswift

Independent Contractor Agreement Template Word Pdf Download Tracktime24

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Easy To Edit Independent Contract Agreement Microsoft Word Etsy

Independent Contractor Agreement Etsy

Independent Contractor Agreement Full Time

The Ceo Legal Loft Shop Small Business Legal Resource

Free Independent Contractor Agreement For Download

Independent Contractor Agreement Creative Contracts

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

Create An Independent Contractor Agreement Download Print Pdf Word

Free Independent Contractor Agreement For Download

Free Independent Contractor Agreement Template Download Wise

Simple Independent Contractor Agreement Construction Contract Contract Template Independent Contractor

Http Www Atri Org Articles Independent contractor agreement Pdf

Automotive Repair Agreement With Self Independent Contractor Agreement Services Provided By Mechanic Us Legal Forms

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Construction Contract Template Contractor Agreement Contractor Contract Construction Contract Contract Template

Independent Contractor Agreement Pdf Template Kdanmobile

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

10 Free Independent Contractor Agreement Templates Printable Samples

Contractor Agreement Template 23 Free Word Pdf Apple Pages Document Download Free Premium Templates

Letter Of Agreement Independent Contractor For Service Templates At Allbusinesstemplates Com

Free Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

0 件のコメント:

コメントを投稿