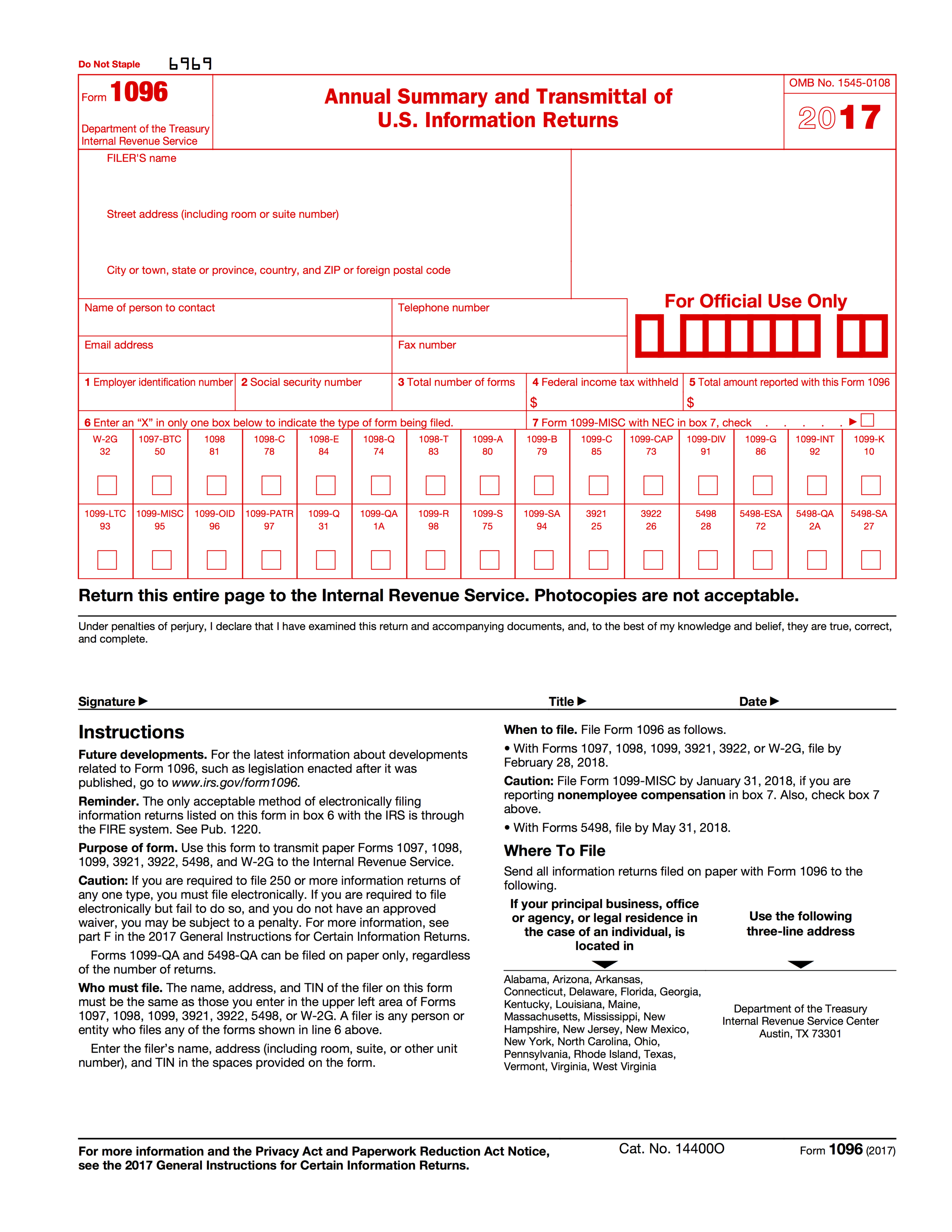

12/1/ · When you file Forms 1099MISC or 1099NEC with the IRS, you must also send Form 1096, Annual Summary and Transmittal of US Information Return There is only one 1096 Form 1096 has a section where you must mark the type of form being filled1/4/19 · USCIS provides this flowchart showing the timing for the I9 form to be completed 2 Download Instructions on How to Fill Out the I9 Form Because the government updates forms annually, it's best to obtain the current I9 form and instructions directly from the USCIS website The form is free, and it can be downloaded as a fillable PDF form or a printable, fillintheblanks3/29/21 · How to Report 1099MISC Box 3 Income Incentive payments and other types of income that appear in Box 3 are reported on Line 8 of Schedule 1 that's submitted with the Form 1040 You would then enter the total amount of other income as calculated on Schedule 1

1099 Misc Template For Preprinted Forms Templates Irs Forms Coding

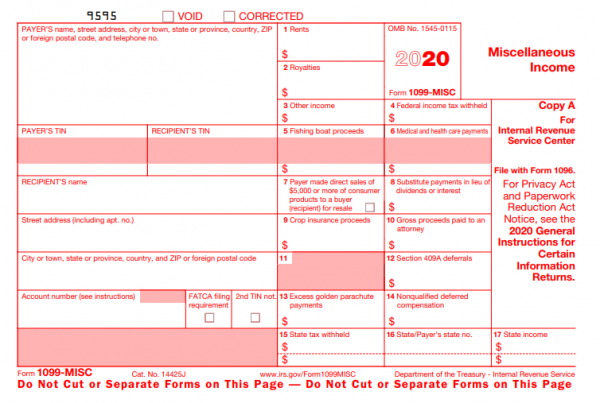

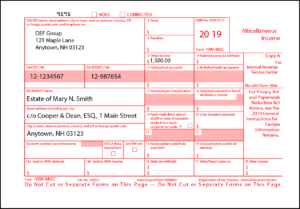

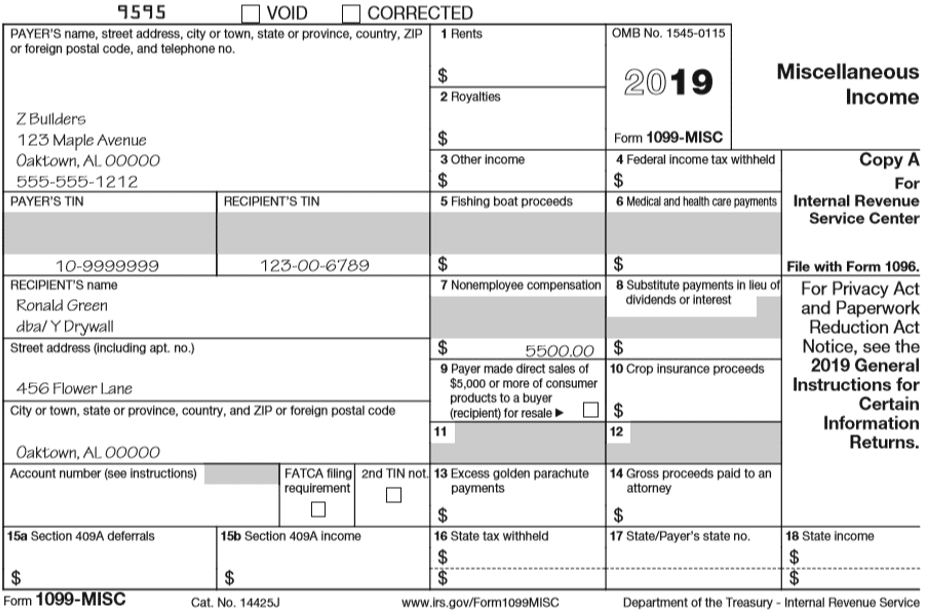

Sample of 1099 misc 2020

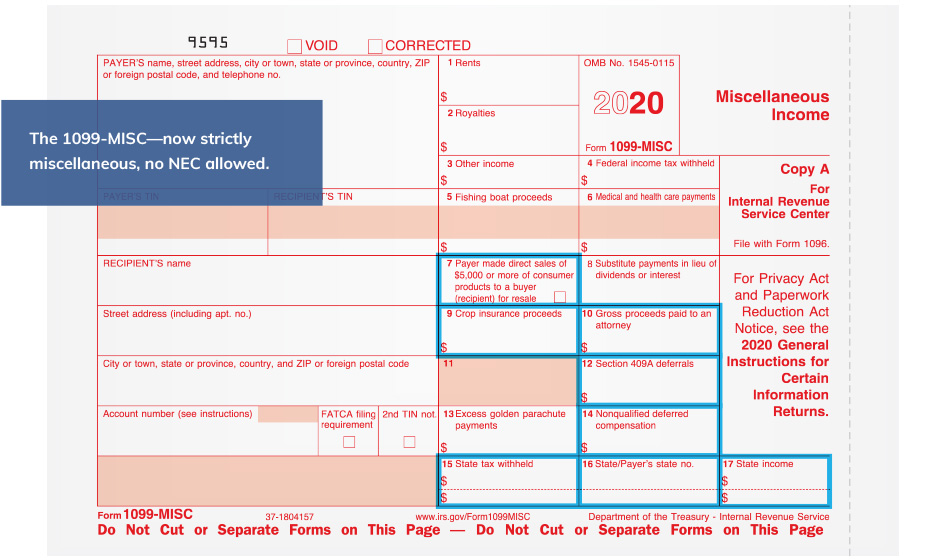

Sample of 1099 misc 2020-9/27/17 · By Amy Examples of rents that must be reported on form 1099MISC include, Now that you have completed form 1099MISC, 1099 Tax Forms, Tax Forms, Form Type 1099MISC Office Depot® Brand 1099MISC Inkjet/Laser Tax Forms For 17 Tax Year With11/3/ · If you fill out Form 1099MISC, you also need to complete and send a copy of Form 1096 to the IRS Form 1096 is a summary form of all the Forms 1099 you file Show the total amount of miscellaneous income you paid throughout the year

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

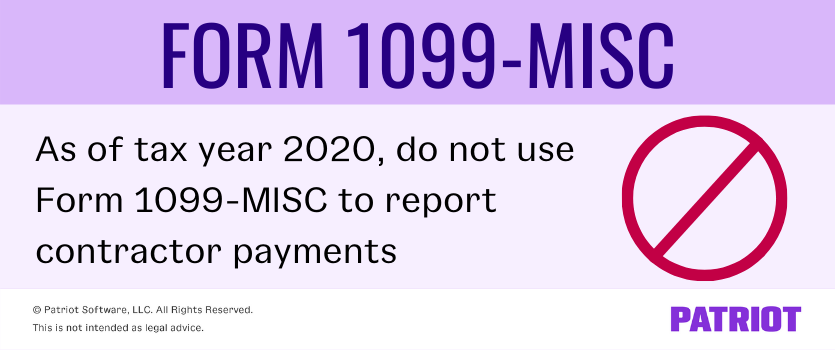

6/9/18 · D Frank Date February 26, 21 Information reported on a 1099 Form is used to complete a person's 1040 Form as part of a federal tax return In the United States, corporations, small businesses and other employers use a variety of forms to record the income earned by employees and independent contractorsTypically, employees of a business in the US receive a11// · Form 1099MISC is still in use for the tax year and beyond, but it no longer includes nonemployee compensation It reports payments such as rents, prizes and awards, medical and health care payments, nonqualified deferred compensation, consumer goods for resale, and royalties —basically miscellaneous payments to anyone who isn't an independentBe sure to complete your nonresident state return before you prepare your resident state return when you get to the State Taxes section

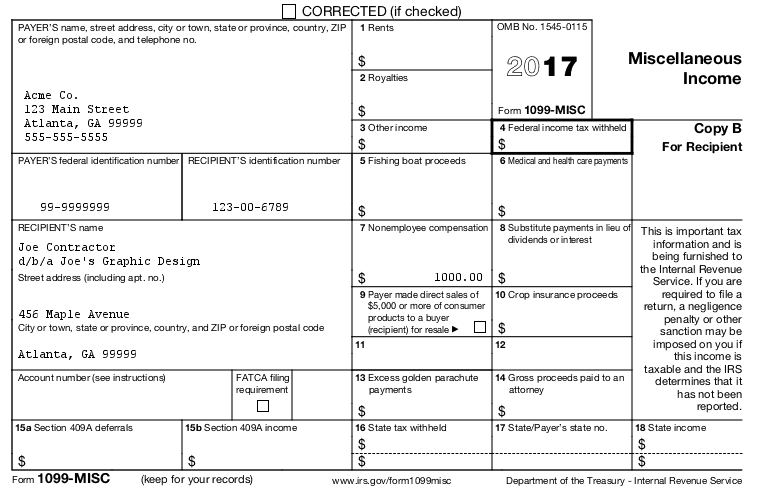

Step 2 Complete Form 1099MISC using the information you gathered in Step 1 Step 3 Submit Copy B to the Contractor no later than January 31 so they can file their own taxes by the deadline Step 4 Submit Copy A to the IRS by February 28 if you're1099MISC Miscellaneous Income 5Part TaxPacks with Envelopes (SelfSeal) TP1099MISC5S 1099MISC Miscellaneous Income 5Part TaxPacks with Envelopes (Gum Seal) TP1099MISC5 1099NEC Nonemployee Compensation 5Part TaxPacks with Envelopes (SelfSeal) TP1099NEC5SMore than 70% of filers in 19 reported information in Box 7 of form 1099MISC

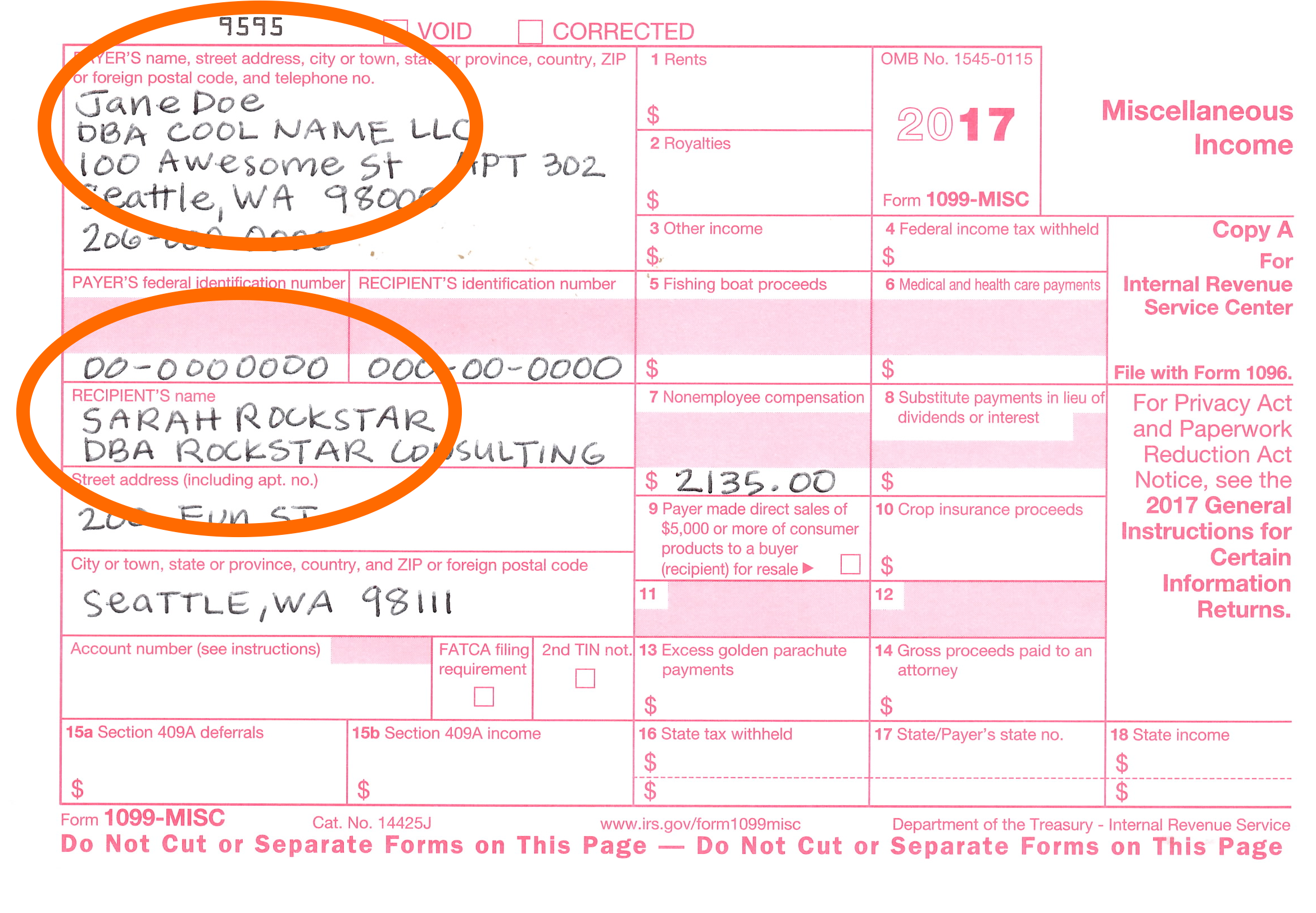

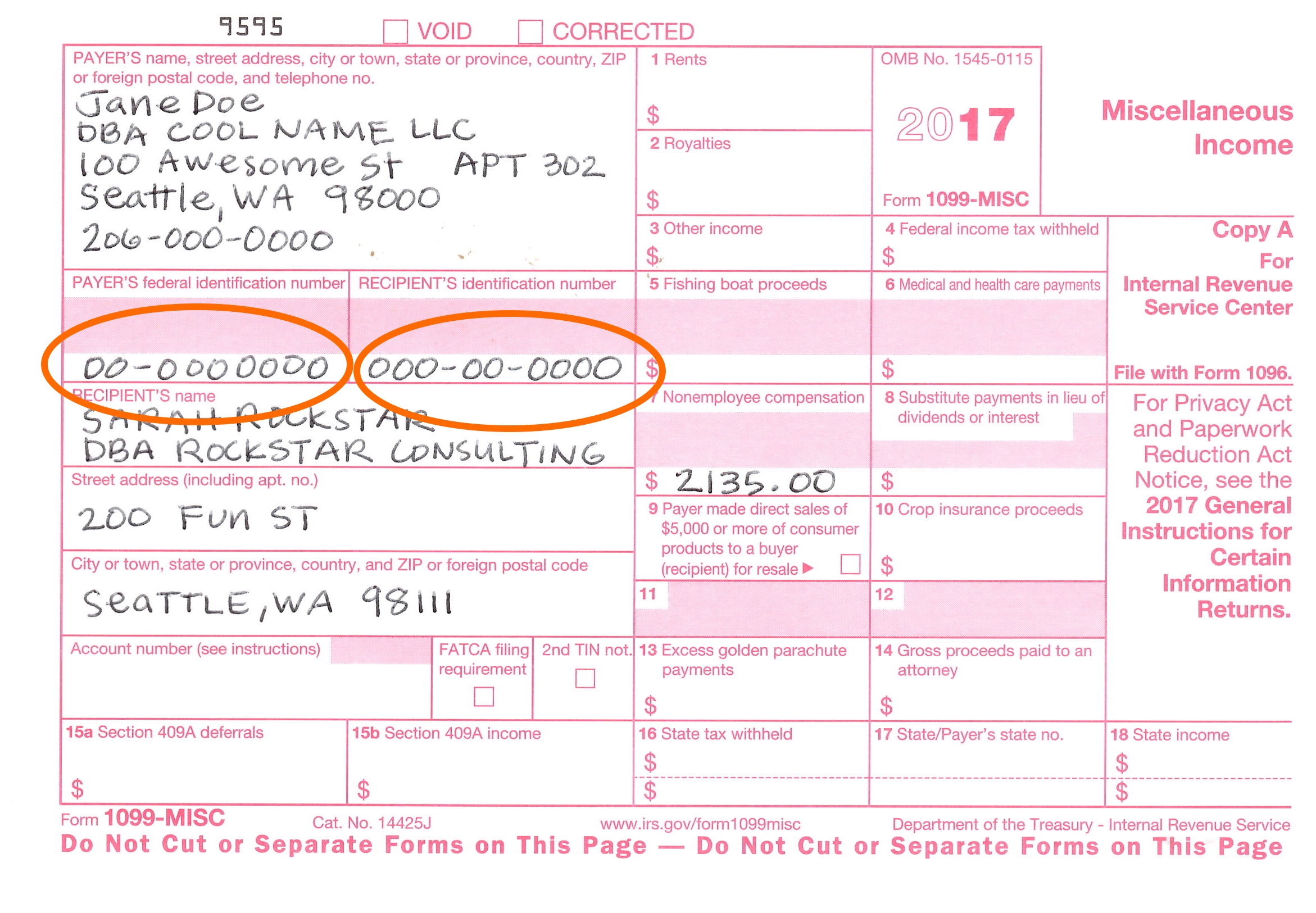

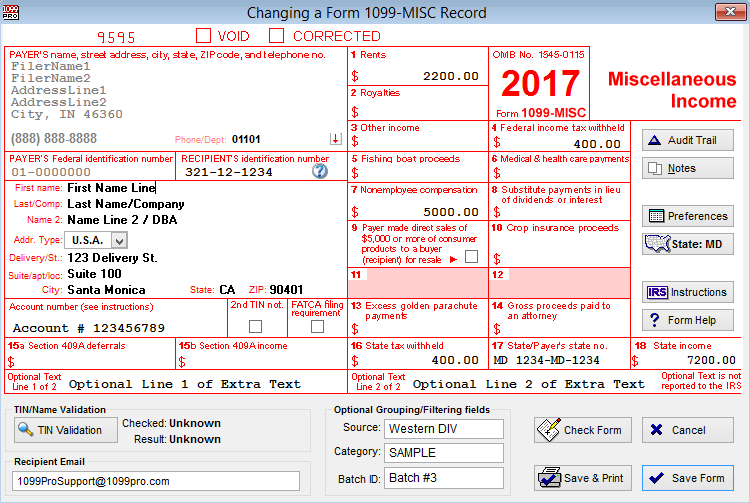

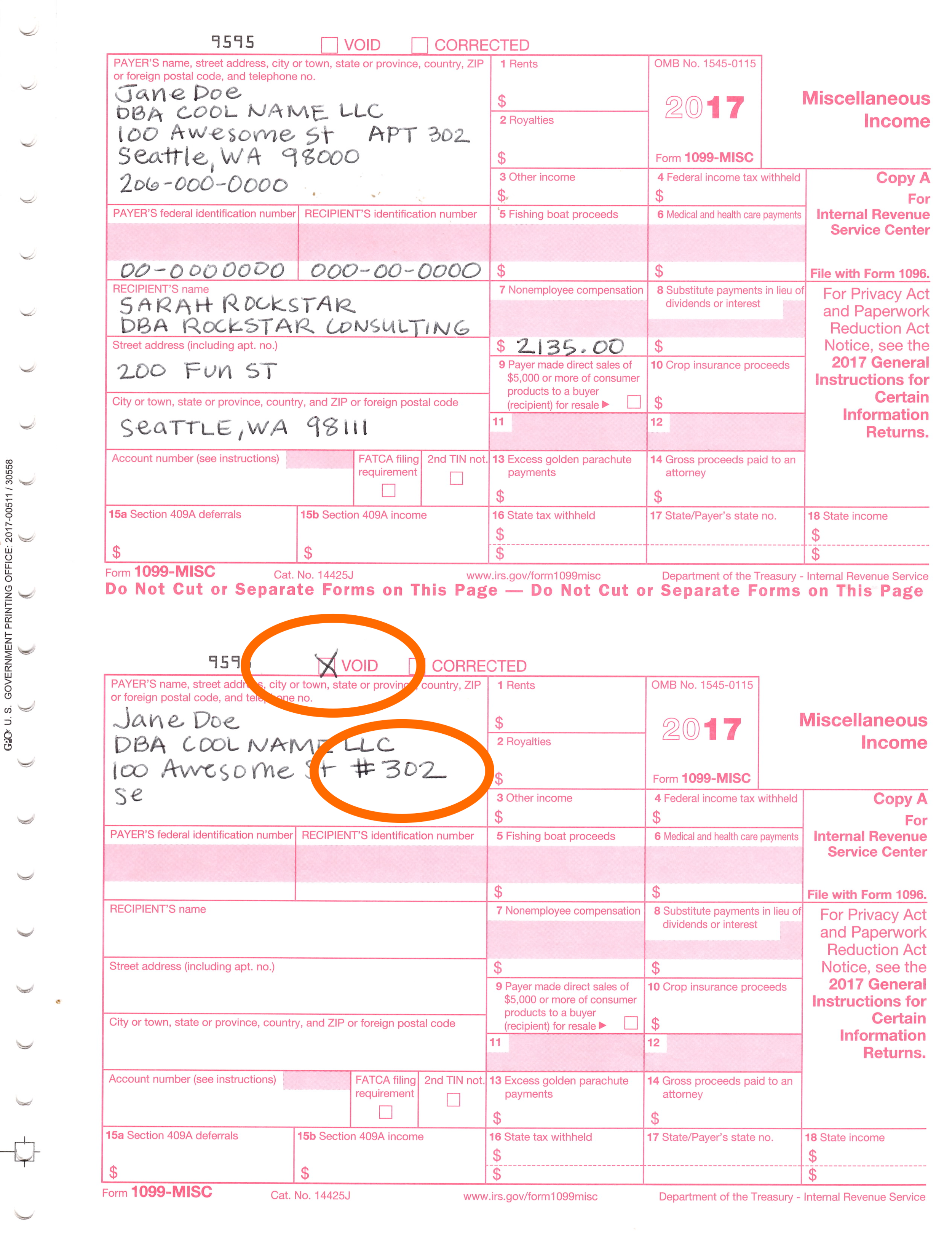

1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 9595 VOID CORRECTEDSample 1099 misc filled out Fill out documents electronically using PDF or Word format Make them reusable by making templates, add and complete fillable fields Approve documents with a lawful electronic signature and share them by using email, fax or print them out download files on your PC or mobile device Boost your productivity with effective solution!Basic 1099MISC Filing Instructions To complete a 1099MISC, you'll need to supply the following data Business information – Your Federal Employer ID Number (EIN), your business name and your business address Recipient's ID Number – The recipient's Social Security number or Federal Employer ID Number (EIN) Payment Amounts – Enter amounts paid in the appropriate box

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Form 1099 Nec For Nonemployee Compensation H R Block

8/12/19 · If you already mailed or eFiled your form 1099's to the IRS and now need to make a correction, you will need to file by paper copy a Red Copy A and 1096, fill out and mail to the IRS, if you need further assistance preparing your corrected paper copy, please contact your local tax provider or call the IRS at (800)6/30/ · For example, let's say your company pays one independent contractor a total of $2,500 and another contractor $1,500 for work done in a single tax year You must send the contractors and the IRS a Form 1099MISC—or, starting in tax year , a Form 1099NEC—to notify them about the amount of nonemployee income you paid to the contractors You will useThe IRS provides specific and clear instructions on when a 1099MISC must be used For example, if you received at least $600 in rental income, you would use a 1099MISC If you paid a lawyer at least $600 for legal services of some kind for your business, you can send them a 1099MISC

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

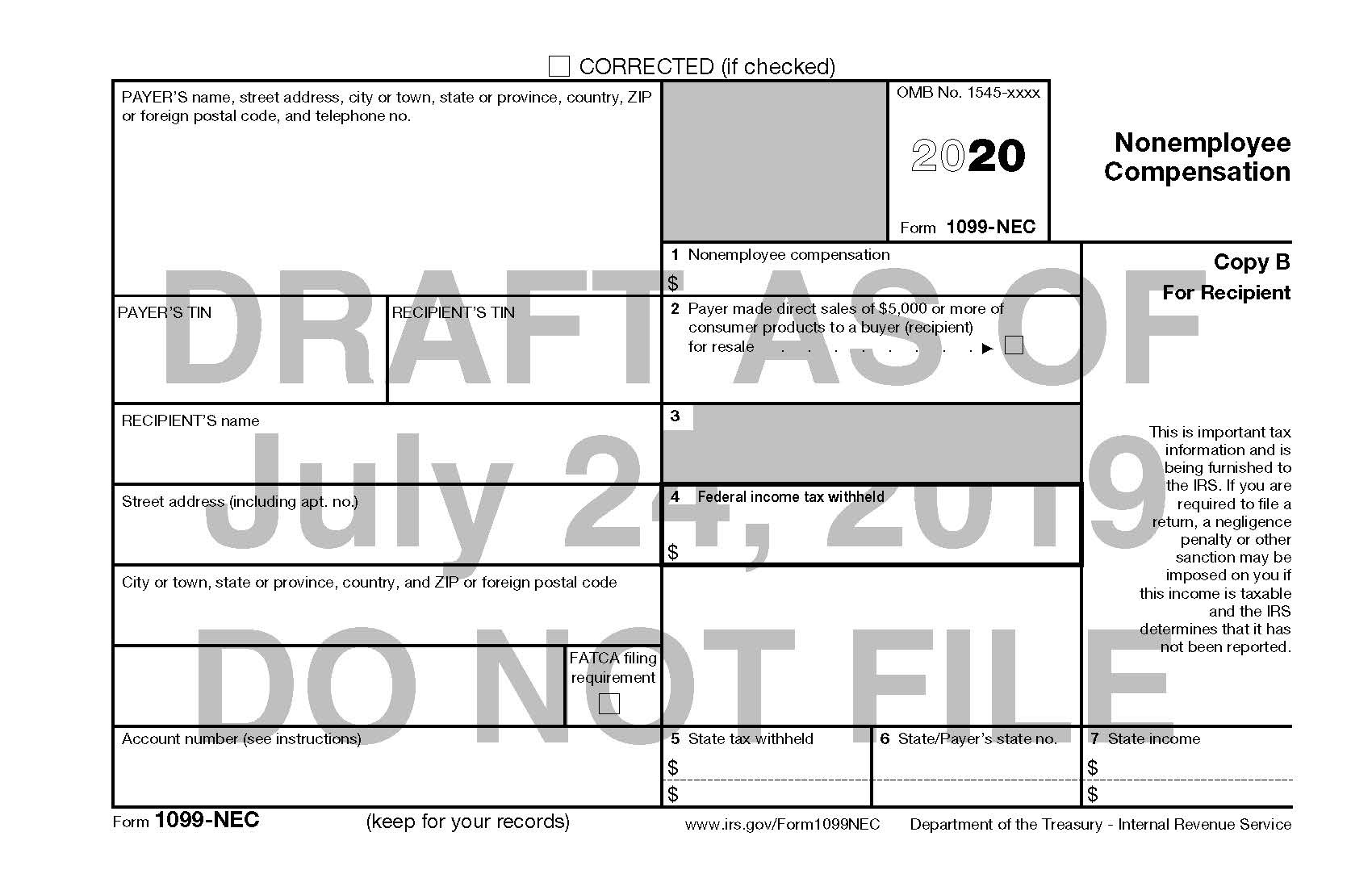

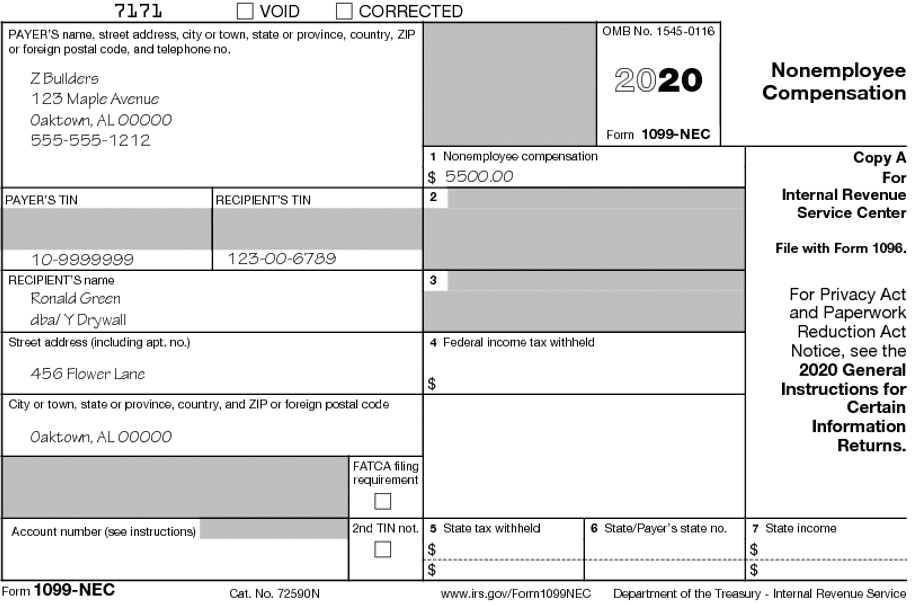

Module 14B Simulation Using Form 1099MISC to Complete Schedule CEZ, Schedule SE, and Form 1040 In this simulation, you will take on the role of James King in order to learn how to claim selfemployment income6/1/19 · Rental property 1099MISC rents and other income Are late rental fees (for example, an additional 10% of the rent) counted as rents or should they be listed as other income?3/29/21 · You'll need to identify workers who are contractors, understand the process for completing a 1099NEC form, and submit the forms properly If you've provided Form 1099MISC to contractors in prior years, you're still in the right place The new Form 1099NEC has replaced 1099MISC to report nonemployee compensation

1099 Misc Tax Basics

Form 1099 Misc It S Your Yale

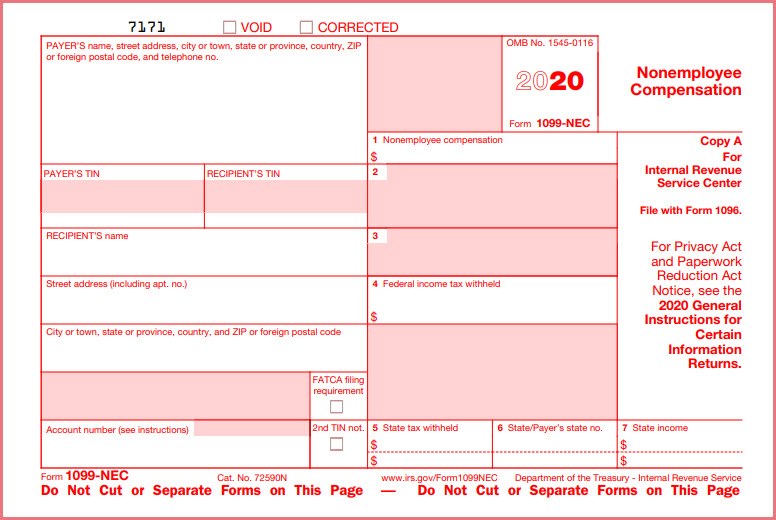

1 NONEMPLOYEE COMPENSATION 1099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plusForm 1099MISC Miscellaneous Income (aka Miscellaneous Information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or taxIn Box 6, enter an "X" in the box for the type of form you are submitting For example, if you are submitting 1099MISC forms, enter an X in the 1099MISC box Check Box 7 if you will not be required to file Form 1096 in the future Sign and date Form 1096 before mailing to the address noted in the instructions Submit Form 1096 To IRS

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Template For Preprinted Forms Templates Irs Forms Coding

10/27/17 · How to Fill Out a 1099MISC Form As a small business owner or selfemployed individual, below are the steps to fill out a 1099MISC form Step One Enter your information in the 'payer' section Complete your personal details in the box in the topleft corner, including your full names, home address, contact number etc Step TwoA 1099MISC is used to report different types of income Based on which box the entry is in and what the income is for, you will report the income differently on your tax return Effective tax year The 1099MISC is no longer used to report nonemployee compensation in box 7 on your tax return Nonemployee compensation will be reported to the taxpayer using Form 1099The form samples include samples for preprinted as well as BIP versions of the 1099 forms You use the preprinted version ZJDE0001 for printing the form output on the office supply stock of 1099 forms where you only create the data on the already printed form However, when you use the BIP version, the system creates the entire form as well as the

Your Ultimate Guide To 1099s

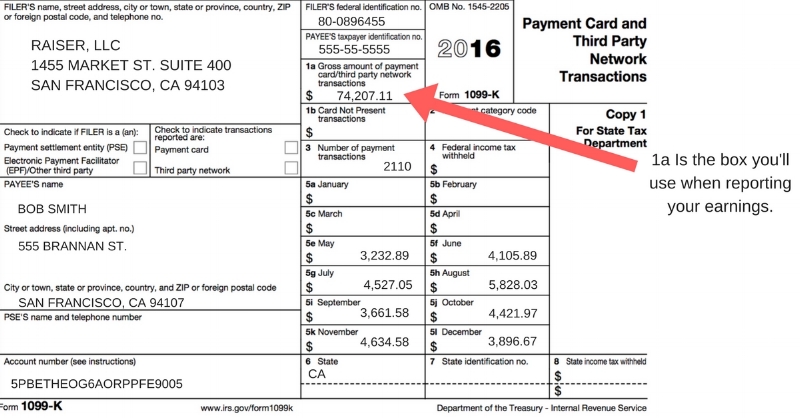

1099 K Tax Basics

A 1099Misc form is a tax form used to report miscellaneous payments that a company made for the reporting tax year Examples of income reported on a 1099Misc include payments to an attorney, health care payments, royalty payments, and substitute payments a person receives instead of2/26/19 · 1099misc This broad 1099 form is issued when you receive at least $600 in rent, prizes, worked for an organization or individual for which you were not an employee or earned money from other2/18/21 · A very active Airbnb listing for which hosts have more than 0 guest bookings per year would be an example of side income that would lead to issuance of a 1099K Ridesharing drivers will also receive a Form 1099K for gross ride receipts accrued during the tax year, in addition to a Form 1099MISC

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

1099 Nec And 1099 Misc Changes And Requirements For Property Management

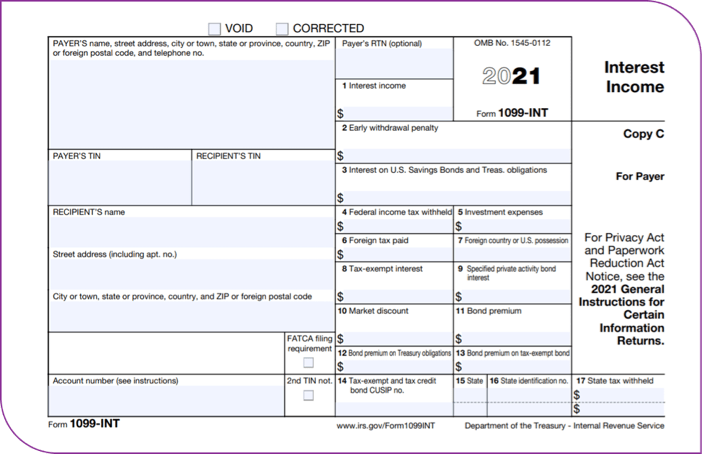

On the completion of the 1099 MISC, a copy also needs to be sent to the recipient This is Copy B and should be sent across to the "nonemployee" before January 31 st Contrary to Copy A, Copy B can be downloaded and printed from the IRS' official websiteH 1099 Sample Forms This appendix includes the following sample forms Appendix H, "1099 Miscellaneous Income (Updated for 1099)" Appendix H, "1099 Nonemployee Compensation" Appendix H, "1099 Dividends and Distributions (Updated for 1099)" Appendix H, "1099 Interest Income" These forms are for informational purposes onlyForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

1099 Misc Form Fillable Printable Download Free Instructions

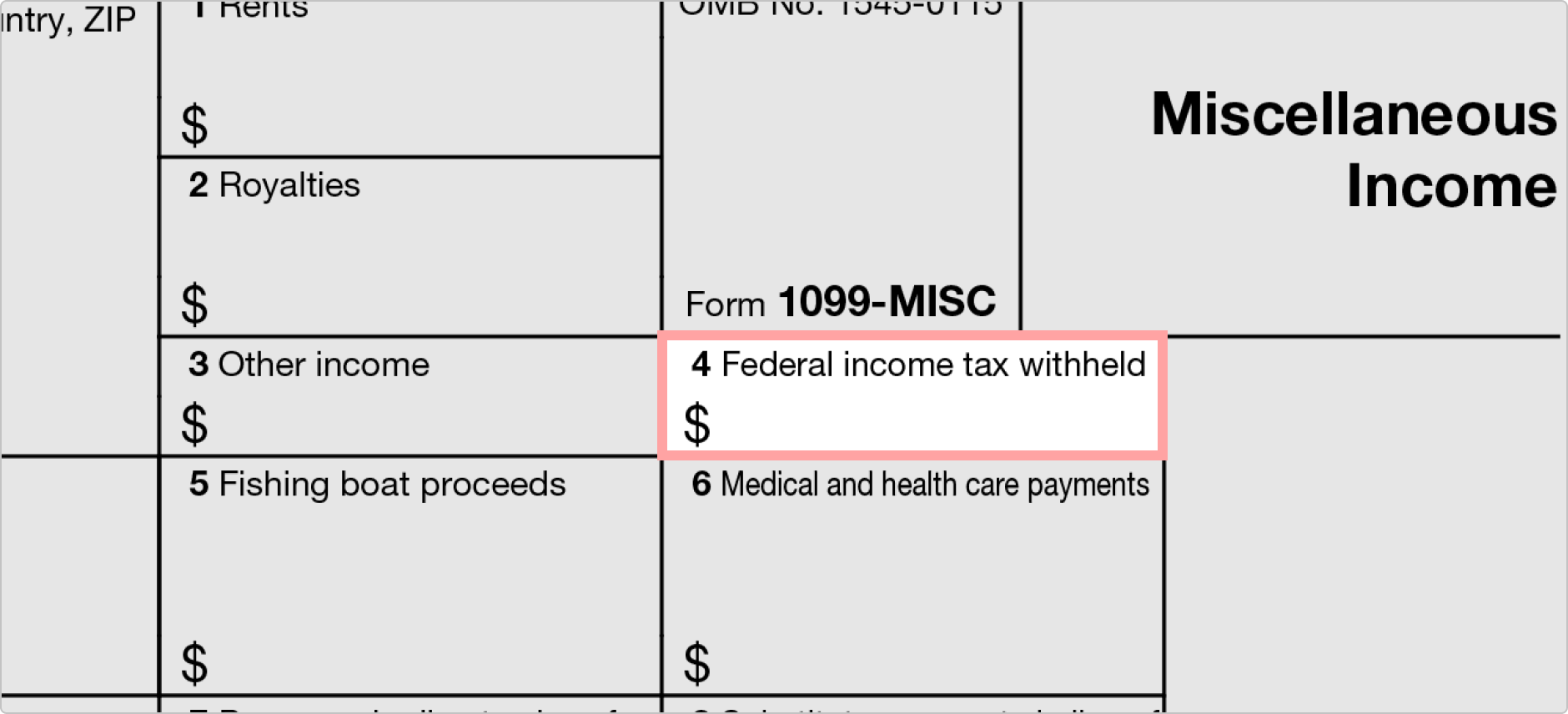

1/7/14 · Sample of completed 1099 MISC form click for larger image Corporations Do I need to issue 1099 forms for payments made to corporations?Enter it in Box 3 if the amount is $600 or more Any backup withholding can be specified in box 4 How to fill out boxes 56 on 1099MISC3/25/17 · How to fill out boxes 14 on 1099MISC In boxes 12, enter rental payments of $600 or more and gross royalty payments of $10 or more Have other income to report that will not be reported elsewhere on the form?

How To File 1099 Misc For Independent Contractor

Form 1099 Misc Instructions And Tax Reporting Guide

Miscellaneous Income 1099MISC 2up Federal Copy A form Order the quantity equal to the number of recipients for which you file Plus FREE SHIPPING to the continental 48 states IMPORTANT You may need to use the new 1099NEC form with or instead of the 1099MISC!Sample of Fillable 1099 Misc Form IRS Federal Tax 1099 Misc Form Online Filing with the IRS and send the form to the recipient support@form1099onlinecom 1099 Misc Box 7 Changed to 1099 NECWith this kind of language included in my purchase agreement, the seller can agree to bear the responsibility for filing the 1099SThis is a significant help because, without this language, I would have to collect the seller's Tax ID number (which is something many people may be hesitant to provide), complete the 1099S myself and send a copy to BOTH the IRS and the Seller

How Do You File 1099 Misc Wp1099

Irs Launches New Form Replacing 1099 Misc For Contractors In Cpa Practice Advisor

2/10/19 · Sample Completed 1099 Misc Form Sample Cms 1500 Form Completed Completed Cms 1500 Claim Form Sample Sample Cms 1500 Claim Form Completed Sample Completed Hcfa 1500 Form Sample Completed 1500 Claim Form 1099 Misc Template 17 Unique Sample 1099 Form Best Sample Resume For Freshers Forms And1/9/ · If you run a small business, you may work with a number of contractors, freelancers and vendors throughout the year If you pay a particular contractor $600 for more for their services during any given year, you must complete an IRS Form 1099MISC In general, taxes are not taken out at the time that payment · 1099 example for small business owners Let's say you own a minigolf course, and it needs some touching up You hire a local landscaper to come in and beautify the area around the eighteenth hole The landscaper works solo, operating as a sole proprietorship He comes in and plants eighteen miniature palm trees

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Account Ability Tax Form Preparation 19 Download And Install Windows

2//19 · Sample Completed 1099 Misc Form Form Resume Examples #q25ZQa3D0oFor example, for tax years prior to , if you are reporting a 1099MISC with income shown in Box 7, the program will prompt you to create a Schedule C for that income so that your income is accurately reported to the IRS and also allows you to report1/31/ · Hello, I have TurboTax Deluxe and received a 1099MISC along with a W2 After I complete everything, the Smart Check finds errors that need to be corrected, it brings me to the Schedule C which makes me enter my "business" information I do not have a business, but I realize that with 1099MIS

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

What Is The Account Number On A 1099 Misc Form Workful

What is Form 1099 MISC?Form 1099MISC 12 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city, state, ZIP code, and telephone no PAYER'S federal identification number RECIPIENT'S identification number RECIPIENT'S nameWhat is a 1099, why these forms need to be completed, how they should be prepared, and to whom they should be sent

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemble The Act Fillable Forms Irs Forms Accounting

Redesigned Form 1099MISC Due to the creation of Form 1099NEC, we have revised Form 1099MISC and rearranged box numbers for reporting certain income Changes in the reporting of income and the form's box numbers are listed below • Payer made direct sales of $5,000 or more (checkbox) in box 7 • Crop insurance proceeds are reported in box 91/11/19 · Updated November 17, Download PDF Understanding 1099s is a common issue for businesses during tax season In this guide, we have included the information you need to know about the 1099 form such as;No, in general you do not need to issue 1099 forms for payments you made to a corporation For instance, if you pay a corporation that, say, provides Web design services or some other business service, you

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Who Should Receive Form 1099 Misc

1099 Misc Software To Create Print E File Irs Form 1099 Misc

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Fillable 1099 Form 16 1099 Fillable Form Fill For 1099 Fillable Form 17 1099 Resume Examples Form Example Fillable Forms

The New 1099 Nec

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

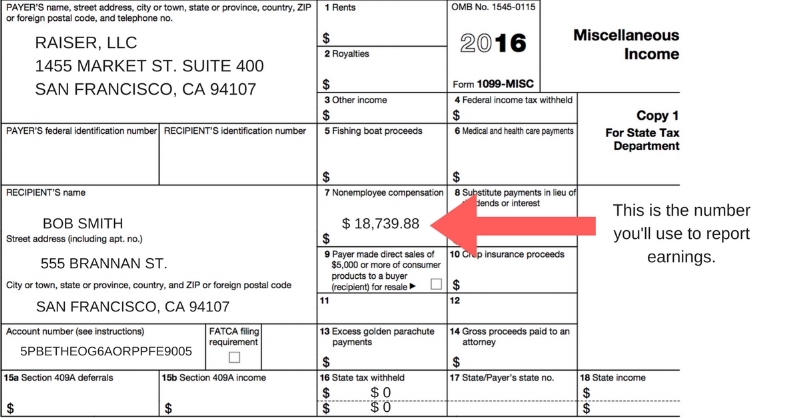

Understanding Your Tax Forms 16 1099 Misc Miscellaneous Income

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form Fileunemployment Org

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

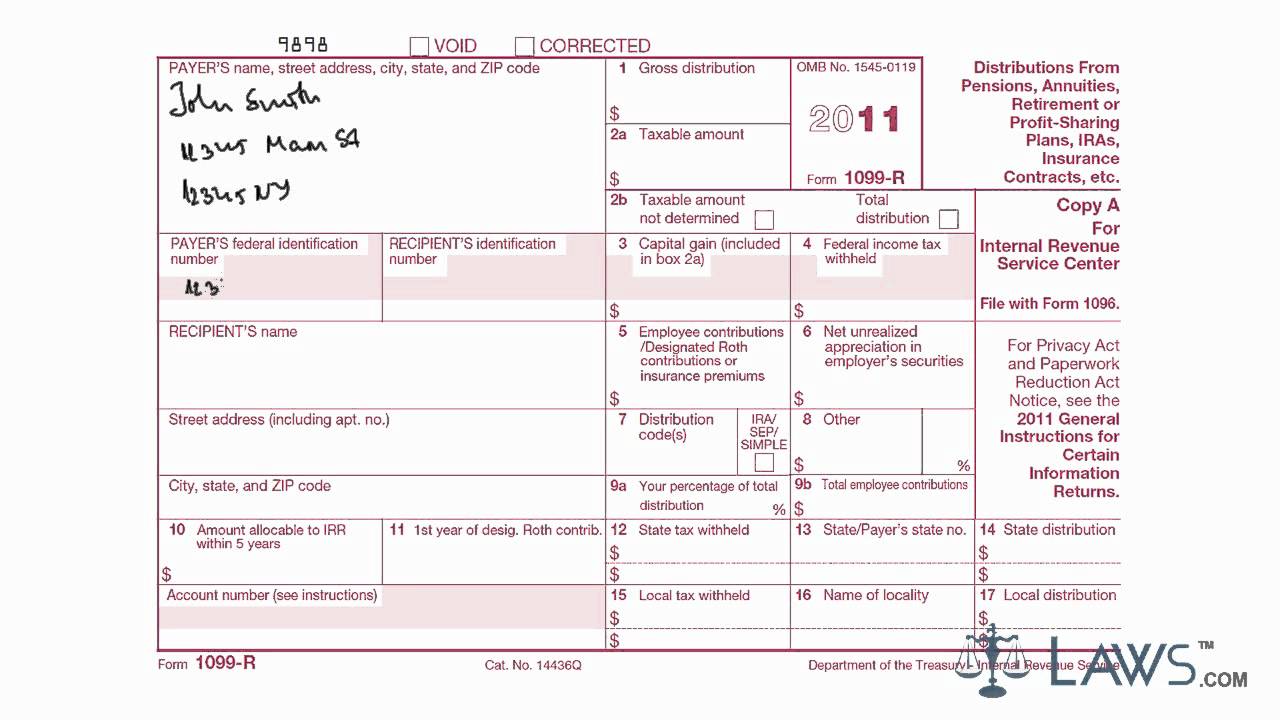

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

Performing 1099 Year End Reporting

What Are Irs 1099 Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Are Irs 1099 Forms

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

1099 Misc Instructions Irs Form 1099 Misc 1099 Misc Contractor

How To Fill Out Form 1099 Misc Youtube

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Form 1099 Misc Bhcb Pc

1099 Misc Instructions And How To File Square

1099 Misc Public Documents 1099 Pro Wiki

1099 Misc Form Fillable Printable Download Free Instructions

Sample 1099 Misc Forms Printed Ezw2 Software

How To Time Prepping Your 1099 Misc

1099 Nec Software Print Efile 1099 Nec Forms

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Sample 1099 Misc Forms Printed Ezw2 Software

Processing The Final Paycheck For A Deceased Employee Checkmate Payroll

Federal 1099 Filing Requirements 1099 Misc 1099 K

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc It S Your Yale

How To File 1099 Taxes Online Unugtp

1099 Misc 18 Public Documents 1099 Pro Wiki

1099 Nec Form Copy B 2 Discount Tax Forms

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

1099 Sample Forms 19

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

1099 Misc Form Fillable Printable Download Free Instructions

How To Fill Out And Print 1099 Nec Forms

Order 1099 Nec Misc Forms Envelopes To Print File

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Setup Supplier And Company

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

1099 Misc 14

15 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

You Can T Trust Your 1099s Endovascular Today

Form 1099 Misc Katopia Design

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Visioncore How To Topics

Understanding 1099 Form Samples

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

1099 Form 19

S A M P L E 1 0 9 9 M I S C C O M P L E T E D Zonealarm Results

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Tax Software Blog 1099 Forms

F 1099 Misc

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Irs 1099 Misc Form Pdffiller

0 件のコメント:

コメントを投稿